Establishing California Residency

Resident and nonresident classification for enrollment purposes are determined at the time of application to Hartnell College. If your residency classification is incorrect, students must submit a residency reclassification and supporting documents for review.

- Residents: A resident student is one who has been a resident in California for more than a year immediately preceding the beginning of the semester in which the student plans to enroll and who demonstrates the intent to remain a permanent California resident.

- Non-Residents: A non-resident student is one who has not had residency in California for more than one year immediately preceding the beginning of the semester. Non-resident students are required to pay non-resident tuition in addition to enrollment fees.

Eligible students that intend to become residents of California must fulfill both the Physical Presence and Intent requirements listed below. Please note that if you are claimed as a dependent on your parents’ income tax returns filed in a state other than California, you are NOT eligible to establish California residency.

Establishing physical presence and intent

To meet these requirements, you must be continuously physically present in California for more than one year (366 days) immediately prior to the residence determination date (the first day of the semester) and intend to make California your home permanently. You must demonstrate your intention to stay in California by relinquishing legal ties to your former state and establishing legal ties to California.

Here is how to establish intent:

- Remain in California when school is not in session.

- Register to vote and vote in California elections.

- Designate your California address as permanent on all legal matters such as school and employment records, including current military records, taxes, bank statements, etc.

- Obtain a California driver's license within 10 days of settling in California, and no later than the campus deadline. (Non-drivers must obtain a California identification card.)

- If you own a car, obtain a California motor vehicle registration within 20 days of settling in California.

- Work in California and file California resident income tax returns effective from the date of residency in the state. Income earned outside of California after that date must also be declared in California.

- Surrender all out-of-state identification (including driver's license).

- Establish a permanent home in California where your belongings are kept.

- Obtain a license for professional practice in California, if applicable.

You will need to relinquish out-of-state ties and demonstrate intent while simultaneously meeting the physical presence requirement.

Non-resident students that wish to change their status or students that feel they have been classified as non-residents in error will need to apply for reclassification of residency status.

Absences from California

In order to demonstrate intent, it is important to stay in California during nonacademic periods. If you’re a nonresident student who is in the process of establishing California residency, and you leave California for more than one month during the summer before the term in which you are establishing resident status, your intent will be questioned. Absences exceeding 6 weeks during the one-year qualification period is disqualifying.

Active duty military, veterans, and their dependents may also qualify for residency or a non-resident tuition exemption. Documentation could include active duty orders, Leave and Earnings Statement (LES), DD214 discharge papers, and/or Certificate of Eligibility.

Submit documents to the Admissions & Records Office in person or via email at admissions@hartnell.edu.

California Non-Resident Tuition Exemption (AB 540) as amended by Education Code section 68130.5

Under the provisions of AB 540 (2001), certain nonresident students who have attended high school in California are exempted from payment of nonresident tuition at public colleges and universities in California, including Hartnell.

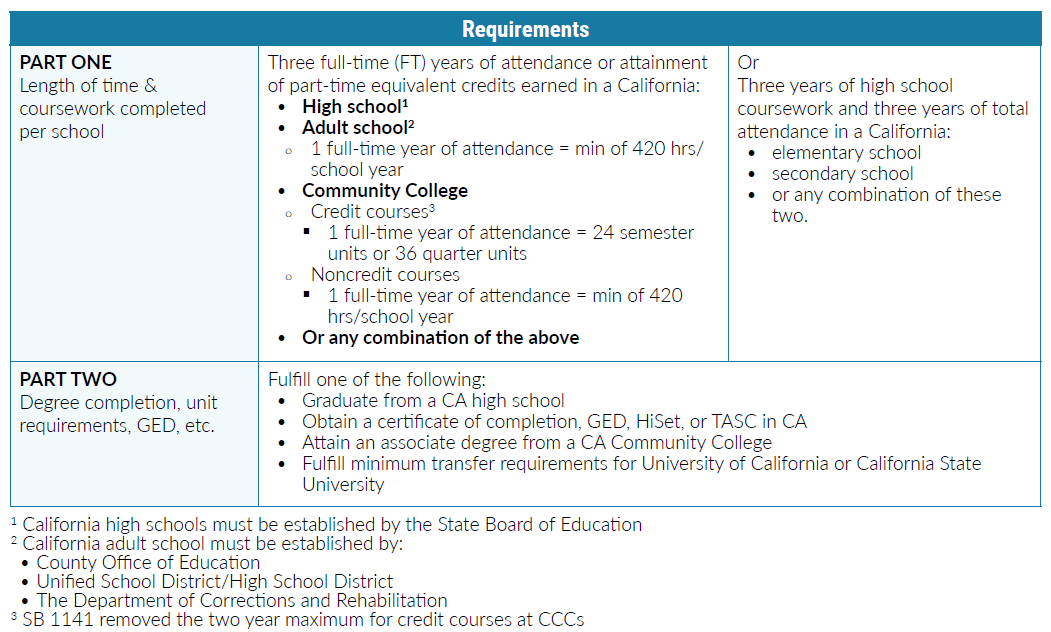

SB 68 expands AB540 requirements and enables students to count years spent at a California Community College and Adult School towards AB 540 eligibility.

Any student, other than one with a United States Citizenship and Immigration Services (USCIS) non-immigrant visa status (see exception below for students who have been granted T or U visa status), who meets all of the following requirements, shall be exempt from paying nonresident tuition at the California Community Colleges, the University of California, and the California State University (all public colleges and universities in California).

If you are an undocumented individual, hold a T and U visa, are a U.S. citizen, and are a lawfully present immigrant that meet the eligibility criteria, you are eligible.

To be considered for the nonresident tuition exemption under AB 540/SB 68, students must meet 2 requirements:

- Length of time & coursework completed per school; and

- Degree Completion, Unit Requirements, GED, or other

Instructions for completing and submitting the CA Non-resident tuition exemption request form:

If you feel you are eligible for this exemption:

- Fill out the California Nonresident Tuition Exemption Request Form (AB 540 form)

- Gather your transcripts /attendance records

- Submit form along with your official transcripts/attendance records to Admissions and Records Office in person at any of the Hartnell College locations or via email at admissions@hartnell.edu

Important deadlines

| Term applying for | Deadline |

| Fall | 3rd Friday in August |

| Spring | 2nd Friday in January |

| Summer | 3rd Friday in May |

If you are an undocumented student, there might be state financial aid available to help you pay for your tuition, visit the Financial Aid website for more information.

For additional information on resources to undocumented students, please go to our UndocuScholar Resource Center website.

Students that are in the United States with a visa that allows establishment of residency must fulfill the one year physical presence and intent requirements listed above. Students with a visa that precludes establishment of residency, will be charged the California enrollment fee plus non-resident fees and an out-of-country surcharge. International Student in F-1 visa status must contact the International Student Program to obtain critical admission requirements.

How to Apply for Residency Reclassification

We encourage students to start the residency reclassification process before they sign up for classes. If you don't pay your fees on time because you are trying to get in-state tuition, then you may be dropped from your classes.

- Incomplete packets will be returned.

Important deadlines for Applying

| Term applying for | Deadline |

|---|---|

| Fall | 2nd Friday in August |

| Spring | 1st Friday in January |

| Summer | 2nd Friday in May |

Frequently Asked Questions

If you have done any of the following over the past year in a state other than California, these are considered actions against intent, and you will not be granted California residency. Some examples are:

- Attending an educational institution as a resident of another state

- Having a driver’s license or automobile registration in another state

- Voter registration and voting in another state

- Having a divorce petition or lawsuit in another state

- Reporting tax information in another state

- Entering into a legal agreement in another state

- In the U.S. with a nonresident visa

The following visa statuses MAY establish residency:

- A-1 to A-3

- E-1, E-2, E-2C, E-3

- G-1 to G-5

- H-1B, H-1C, H-4

- K-1, K-2, K-3, K-4

- L-1A, L-1B, L-2

- N-8, N-9

- NATO 1 to 7

- O-1, O-3

- R-1, R-2, R-3

- SIV

- T-1 to T-6

- U-1 to U-5

- V-1, V-2, V-3

NOTE: Noncitizens admitted to the United States on an immigrant visa status would be considered eligible to establish residence even if a particular visa number is not listed above.

The following visa status holders cannot establish residency regardless of the length of time in California:

- B-1, B-2 - Individuals with a B-1 or B-2 visa are prohibited from enrolling in a course of study.

- C-1 to C-4

- D-1, D-2

- F-1, F-2, F-3

- H-1B1

- H-2A, H-2B, H-3, H-4

- J-1, J-2

- M-1, M-2, M-3

- O-2, O-3

- P-1

- P-2

- P-3

- P-4

- Q-1 to Q-3

- S-5, S-6, S-7

- TN/TD

- TWOV

- Noncitizens under an “Order of Supervision” are also not able to establish California residence for tuition purposes.

- With the exception of “advance parole” for individuals with a pending I-485 (Application to Register Permanent Residence or Adjust Status), Noncitizens on “parole” status are admitted only on a temporary basis and as such are not eligible to establish California Residency.

- Visitors possessing a Border Crossing Card (BCC), Bering Straits (BE agreement entrants, Visa Waiver Program (VWP) entrants under nonimmigrant categories WB and WT.

If you are the holder of one of these types of visas – but you have filed for a change of status – then you may submit a request for residency reclassification. Your residency determination date is based on the date of your application of change of status. Make sure to include a copy of the Notice of Action from INS for the status adjustment..

The first day of the semester is the residency determination date. Living in California for 12 months does not automatically qualify you for in-state tuition fees.

Under California law, if you moved to California primarily to attend a California college, then you are not eligible for in-state tuition fees.

You must prove through official and/or legal documents that you have moved to California permanently and are not just living in California temporarily while you attend college, however long your course of study takes.

Students under 19 years of age and unmarried typically derive California residency from their parents. The parents must meet the eligibility requirements and provide documentation demonstrating physical presence in California and intent to make California their permanent residence. Note: Students older than 19 usually do not derive residency from a parent.

Alternatively, students seeking reclassification from non-resident to resident status can show financial independence from any non-resident parent or guardian according to guidelines set forth by the State of California.

To establish financial independence, a student seeking reclassification must show the extent to which they have met the following criteria for the current and each of the immediately preceding three (3) calendar years:

- The student has not been claimed as an exemption for state or federal tax purposes by their non-resident parents.

- The student has not received more than $750 from their non-resident parents.

- The student has not lived in the home of their non-resident parents for more than six weeks in any given year.

Failure to satisfy all the financial independence criteria for the entire period will not necessarily result in classification as a non-resident if the showing of one year’s presence and intent is sufficiently strong. However, failure to satisfy all three financial independence criteria for the current and immediately preceding calendar years will normally result in classification as a non-resident, since financial independence is of greater significance for those years.

Financial independence, or want of it, for the second and third calendar years immediately preceding the year in which reclassification is requested will be considered together with all other relevant factors in determining intent, with no special weight attached to the financial independence factor. Evidence of financial independence may be presented in the form of:

- Affidavits signed by student and parent indicating the extent to which the three criteria listed above have been met

- Copies of the federal and state income tax returns filed by student and/or parent for the current and any applicable preceding calendar years

Financial hardship cannot be considered in evaluating California residency for the purpose of in-state fee eligibility.

A student cannot derive residency status from their spouse or domestic partner.

The residence of a minor (a person under 18 years of age) is determined in accordance with the following, per California Education Code and Title 5:

- The residence of the parent (natural or legally adoptive ) with whom an unmarried minor lives is the residence of that minor, regardless of the length of time the minor has resided with that parent. This rule applies equally to a minor whose parents have permanently separated.

- A married minor may establish their own residence. A minor who has married but thereafter divorced retains the capacity to establish their own residence. A minor whose marriage has been annulled must be treated as an unmarried minor since, for all intents and purposes, a marriage has not occurred.

- If the minor lives alone, they take the residence status of the parent with whom they last lived.

- If both parents are deceased and there is no court-appointed guardian, then the minor may establish residence as though they were an adult.

- The residence of an unmarried minor who has a living parent cannot be changed by the minor's own act, by the appointment of a legal guardian, or by relinquishment of a parent's right of control.

- A student who has been adult for less than a full year (is under 19 years of age) may under certain circumstances combine the immediate pre-majority derived California residence with the immediate post-majority California residence to satisfy the one year necessary for residency classification.

Supporting documentation consists of three proofs of residency demonstrating physical presence and intent. The items must be dated one year and one day prior to the start of the term for which you are applying for. These items must not be older than two years prior to the start of the term.

To be considered for resident classification students must:

- provide clear and convincing evidence that you have satisfied all residency requirements.

- complete a residency reclassification request before the deadline; if you miss the deadline, you will be responsible for all nonresident fees.

Examples of acceptable documentation are:

- California Driver's License or California ID

- A resident California Tax Form (540)

- California vehicle registration

- Rental/Lease agreement

- California bank statement

A students who has a special immigrant visa that has been granted a status under Section 1244 of Public Law 110-181, under Public Law 109-163, or under Section 602(b) of Title VI of Division F of Public Law 111-8, or is a refugee admitted to the United States under Section 1157 of Title 8 of the United States Code, and who, upon entering the United States, settled in California, shall be exempt from paying the nonresident tuition fee required by Section 76140 for the length of time he or she lives in this state up to the minimum time necessary to become a resident.

Education Code section 68075.6 grants an immediate nonresident tuition fee exemption to eligible Special Immigrant Visa (SIV) holders and refugee students who settled in California upon entering the United States. This exemption is granted for one year from the date the student settled in California upon entering the United States.

This exemption applies to the following:

- Iraqi citizens or nationals (and their spouses and children) who were employed by or on behalf of the United States Government in Iraq (Pub.L. No. 110-181, § 1244)

- Afghan and Iraq translators (and their spouses and children) who worked directly with the United States Armed Forces (Pub.L. No. 109-163, § 1059)

- Afghanistan nationals who were employed by or on behalf of the U.S. government or in the International Security Assistance Force {ISAF} in Afghanistan (Pub.L. No. 111-8, § 602)

- Refugee students admitted to the United States under Section 1157 of Title 8 of the United States Code.