2026 EMPLOYEE BENEFITS GUIDE

The benefits team has created the Employee Benefits Overview booklet which provides summaries of all the benefits offered by Hartnell Community College.

Please access here: https://www.hartnell.edu/hr/benefits/open-enrollment/hartnell-college-benefits-summary-booklet.pdf

Rates at a Glance: https://www.hartnell.edu/hr/benefits/2026-benefits-rates-at-a-glance.pdf

You can also see the Summary of Benefits and Coverage for each plan below:

Blue Shield PPO 80-K

Summary of Benefits and Coverage

Blue Shield PPO 80-M

Summary of Benefits and Coverage

Blue Shield PPO HSA

Summary of Benefits and Coverage

Kaiser HMO

NOTE: Your medical card is also your prescription card. You will NOT receive a separate Navitus card.

Coordinating Pharmacy Services How-To

Navitus - Frequently Asked Questions

Costco Mail Order Service - Frequently Asked Questions

- American Fidelity Flyer

-

- Short-term Disability (*Note: District employees do not pay into CA State Disability)

- Accident Only

- Critical Illness

- Hospitalization

- Cancer

-

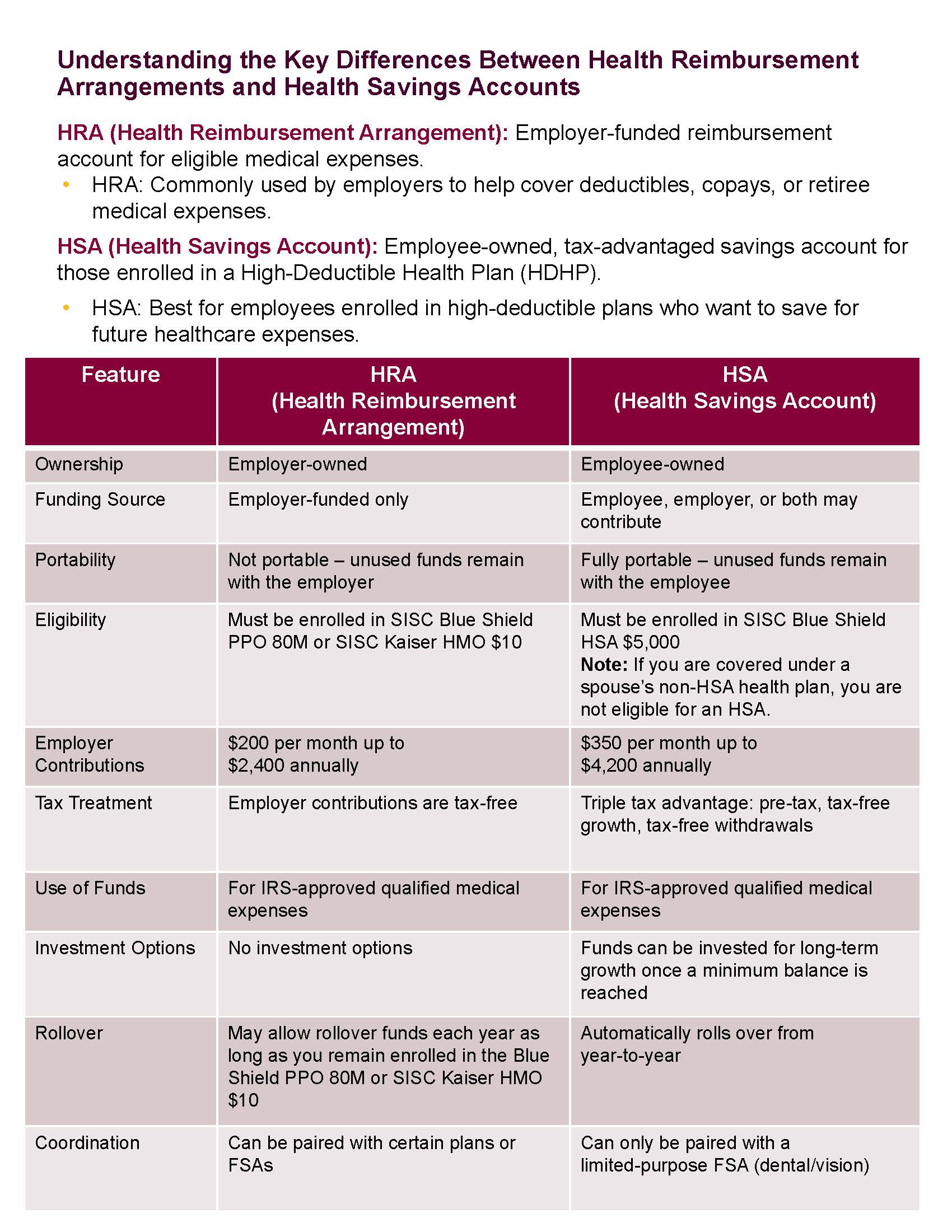

Q: What is an HRA?

A: A Health Reimbursement Account (HRA) is an employer-funded account that reimburses employees for qualified medical expenses. Unlike an HSA or FSA, employees do not contribute to an HRA - the funds are provided solely by Hartnell College. For more information,

visit americanfidelity.com/HRA

Q: How does an HRA work?

1. Hartnell College sets aside a specific allowance for the plan year. In this

case, $200 per month.

2. You pay for eligible medical expenses out of pocket.

3. You submit receipts or claims for reimbursement.

4. Once approved, you are reimbursed tax-free, up to the available balance

in the account.

Q: What types of expenses are covered?

A: HRAs typically cover IRS-approved medical expenses, which may include:

● Deductibles, copays, and coinsurance

● Prescription drugs

● Medical, dental, and vision expenses

●Certain over-the-counter items

For a full list, see American Fidelity’s Eligible and Ineligible Expenses page.

Q: Do I need to be enrolled in a specific health plan to use the HRA?

A: Yes. You are eligible to receive the HRA if you enroll in one of the following:

● Blue Shield PPO 80M

● Kaiser HMO $10

Hartnell College contributes $200 per month into your HRA.

Q: Do unused HRA funds roll over to the next year?

A: Yes, as long as you remain enrolled in a qualified plan such as the Blue Shield

PPO 80M or the Kaiser HMO $10.

Q: How do I get reimbursed?

● Submit a claim through your employer’s administrator (online portal, app,

or paper form).

● Provide receipts or Explanation of Benefits (EOBs) as proof.

● Reimbursements are usually made via direct deposit or check.

Q: How is an HRA different from an HSA or FSA?

● HRA: Funded only by the employer; no employee contributions

● HSA: Employee and/or employer can contribute; portable; must be paired with a high-deductible

health plan

● FSA: Funded by employee pre-tax dollars (sometimes with employer contributions); “use-it-or-lose-it”

rules usually apply

Q: What happens if I change from and HRA eligible health plan to a non-HRA eligible

health plan?

A: If you switch to a non-HRA eligible health plan, any remaining funds in your

HRA will not transfer your new plan. HRA funds are only available while you are enrolled in an

HRA-eligible health plan and cannot be rolled over or used once you move to a non-HRA

eligible health plan option. Be sure to use any remaining HRA funds before your HRA

coverage ends.

Q: What can I do with an HSA?

A: A Health Savings Account (HSA) allows you to use funds you set aside plus Hartnell’s

monthly contribution to pay for qualified medical, pharmacy, dental, and vision expenses—or

save and grow those funds for future use. Hartnell College contributes $350 per month

into your HSA.

Q: How do I use an HSA?

● You can pay directly with your HSA debit card at the time of service or purchase

● Or, pay out-of-pocket and reimburse yourself later

● Make sure to keep all receipts and Explanation of Benefits (EOB)

Q: How can I open an HSA?

A: You can open an HSA with American Fidelity. For more information, you can visit americanfidelity.com/hsa

Q: What is a qualified expense?

A: Qualified expenses are IRS-approved medical, dental, vision, and prescription

costs. Many over-the-counter (OTC) items also qualify.

Eligible expenses include:

● Acupuncture

● Birth control treatment

● Blood sugar test kits for diabetics

● Breast pumps and lactation supplies

● Crutches

● Dental treatments (including X-rays, cleanings, fillings, sealants, braces, and tooth

removals)

● Doctor’s office visits and co-pays

● Drug addiction treatment

● Eyeglasses (Rx and reading)

● Hearing aids and batteries

● Physical therapy

● Speech therapy

● Smoking cessation programs

Ineligible expenses include:

● Cosmetic surgery

● Electrolysis or hair removal

● Toiletries (e.g. toothbrush, toothpaste)

For a full list, see American Fidelity’s Eligible and Ineligible Expenses page.

Who To Contact

- Alma Arriaga

Benefits and Leaves Analyst

benefits@hartnell.edu

Phone: (831) 770-6166

Building: D - College Administration (North)

Office: Room 108

College Administration (North)